Bright Insights Hub

Your go-to source for the latest news and information across various topics.

The Crypto Chaos Chronicles: Thriving Amidst Market Volatility

Navigate crypto chaos with our expert insights! Discover strategies to thrive amidst market volatility and unlock your digital potential.

Understanding Market Volatility: Key Factors Affecting Cryptocurrency Prices

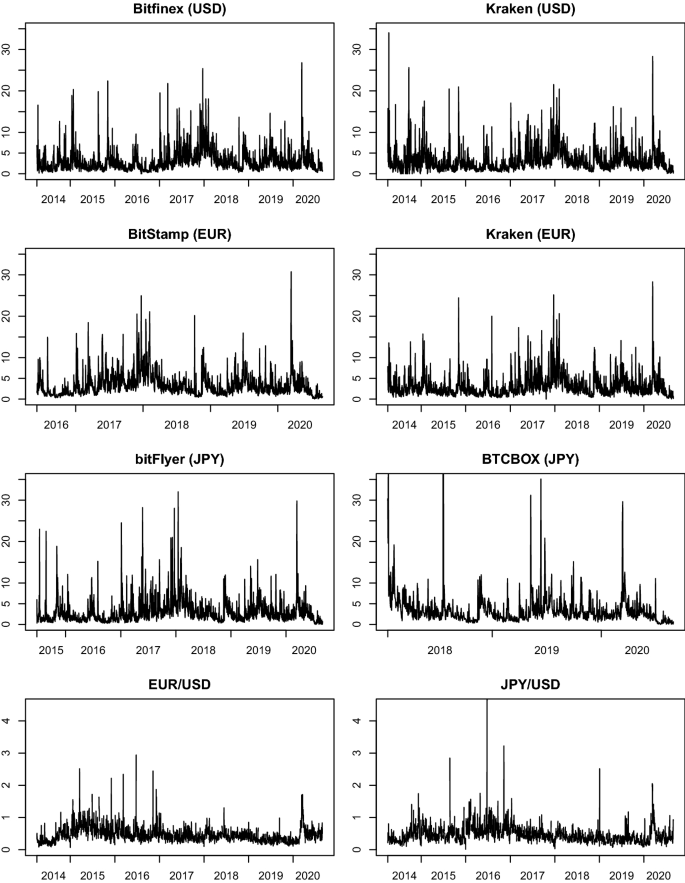

Understanding market volatility in the cryptocurrency space is crucial for both novice and experienced investors. Various factors contribute to the fluctuations in cryptocurrency prices, making it essential to grasp these dynamics. Firstly, market sentiment plays a pivotal role; the psychology of investors often leads to rapid buying or selling based on news, social media trends, or influential figures in the crypto community. For example, a positive announcement regarding regulatory acceptance can lead to a surge in prices, while negative news, such as security breaches or market manipulation, can trigger panic selling, affecting overall market stability.

Additionally, market liquidity significantly impacts price volatility. Cryptocurrencies with lower liquidity tend to experience more pronounced price swings due to the limited number of buyers and sellers. Other factors include economic indicators, such as inflation rates and market conditions, which can influence investor confidence in traditional versus digital assets. Furthermore, technological advancements, regulatory developments, and macroeconomic events all contribute to the fluctuating landscape of cryptocurrency prices. Understanding these influences can aid investors in making informed decisions in a volatile market.

Counter-Strike is a highly popular first-person shooter game that emphasizes teamwork and strategy. Players can engage in various game modes, from bomb defusal to hostage rescue, creating a dynamic gaming experience. For those looking to enhance their gaming experience, using a cloudbet promo code can provide exciting benefits and rewards.

Strategies for Investment: How to Thrive in a Turbulent Crypto Market

In a turbulent crypto market, having a well-defined strategy can mean the difference between profit and loss. One effective strategy is to diversify your investment portfolio across multiple cryptocurrencies and blockchain projects. This approach mitigates risk, as the fluctuations in one asset can be balanced by the stability or gains in another. Consider allocating your investments into established coins like Bitcoin and Ethereum, as well as promising altcoins that show long-term potential. Additionally, keeping a close eye on market trends and technological developments will help you make informed decisions about when to buy or sell.

Another vital strategy is to maintain a long-term perspective. The crypto market is notorious for its volatility, but historically, it has also shown substantial growth over time. Instead of being swayed by short-term price changes, focus on the underlying fundamentals and potential of the projects you're investing in. Utilize tools like stop-loss orders to minimize losses during a downturn, and consistently educate yourself about market trends and new opportunities. By adopting these strategies, you can navigate the ups and downs of the crypto landscape and position yourself for success.

Is Now the Right Time to Invest? Analyzing Market Trends Amidst Chaos

As we navigate through unpredictable economic landscapes, the question on many investors' minds is, "Is now the right time to invest?" Market trends reveal that amidst turmoil, opportunities can arise in unexpected places. Analysts highlight that periods of chaos, whether due to geopolitical tensions, economic downturns, or global health crises, often lead to market corrections. These corrections can present a unique chance for savvy investors to acquire undervalued assets. By observing key indicators such as interest rates, inflation, and consumer sentiment, one can gauge whether the time is opportune for investment.

Moreover, it is essential to adopt a diversified investment strategy tailored to the current climate. According to recent studies, investors who maintain a balanced portfolio generally perform better during volatile times. This approach not only mitigates risk but also allows investors to capitalize on different sectors that may thrive amid chaos. Consider examining the following factors before making your investment decisions:

- Current economic indicators

- Sector-specific performance

- Long-term growth potential

Ultimately, understanding these dynamics can help you determine whether now is the right time to invest or if it is wiser to wait for clearer signals.