Bright Insights Hub

Your go-to source for the latest news and information across various topics.

Crypto Chaos: How Market Volatility Keeps Investors on Their Toes

Discover how crypto market volatility can make or break investors. Stay ahead of the chaos and learn to navigate trade twists!

Understanding the Causes of Crypto Market Volatility

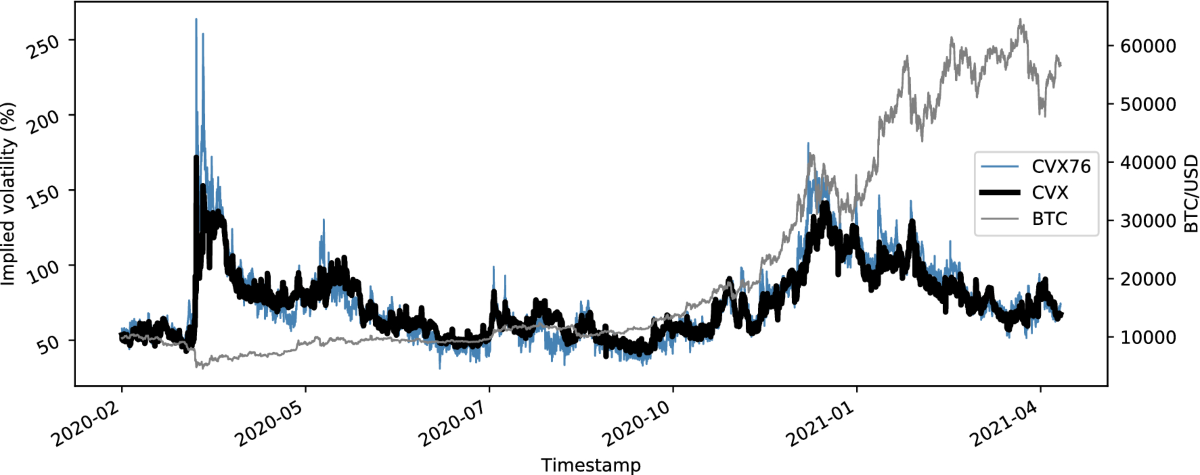

The crypto market volatility is influenced by a myriad of factors that can lead to significant price fluctuations. One primary cause is market sentiment, which is driven by news, social media trends, and events within the cryptocurrency space. When positive news breaks, such as a major corporation adopting Bitcoin, prices can soar. Conversely, negative news, like regulatory crackdowns or security breaches, can lead to panic selling. Additionally, the relatively low market capitalization of cryptocurrencies compared to traditional financial markets often exacerbates these swings, allowing smaller trades to have a more pronounced effect on prices.

Another critical factor contributing to crypto market volatility is the speculative trading behavior of investors. Many participants in the cryptocurrency market engage in short-term trading, aiming to profit from quick price movements rather than investing for the long term. This speculative nature can create an atmosphere of hype and fear, leading to rapid buying and selling. Furthermore, the impact of liquidity can't be overlooked; during times of low liquidity, even a few trades can cause significant price changes, making the market more prone to volatility.

Counter-Strike is a popular first-person shooter game that emphasizes team-based gameplay. Players can engage in various missions, such as bomb defusal or hostage rescue, in a variety of maps. If you're looking to enhance your gaming experience, you might want to check out the cloudbet promo code for exclusive offers.

How to Navigate Investment Strategies During Market Fluctuations

Navigating investment strategies during market fluctuations can be challenging yet essential for maintaining a solid portfolio. Market fluctuations are inevitable, but understanding how to respond to them can mitigate risks and potentially enhance returns. One effective approach is to implement a diversified portfolio that includes a mix of asset classes, such as stocks, bonds, and commodities. This strategy not only spreads risk but also allows you to capitalize on different market conditions. Additionally, consider rebalancing your portfolio regularly to ensure that your investments align with your financial goals and risk tolerance.

Another important strategy is to adopt a long-term perspective. While it might be tempting to react immediately to market dips, history shows that those who remain patient often reap the rewards over time. Using techniques such as dollar-cost averaging can help you invest consistently, regardless of market conditions. Moreover, staying informed about macroeconomic indicators and market trends can provide valuable insights. By keeping a keen eye on the factors influencing market fluctuations, you can make more informed decisions that align with your investment strategy.

Is Market Volatility a Friend or Foe for Cryptocurrency Investors?

The world of cryptocurrency is often characterized by market volatility, leading to a debate among investors about whether it serves as a friend or foe. On one hand, volatility can present lucrative opportunities for quick gains, as prices can skyrocket in a short period. For savvy traders, understanding market trends and using analytical tools can turn fluctuations to their advantage. Moreover, periods of high volatility may attract new investors eager to capitalize on the rising tide of cryptocurrency prices, ultimately boosting the market's overall health.

Conversely, this same volatility can act as a foe for more conservative investors seeking stability. Sudden price drops can lead to significant financial losses, fostering a sense of fear and uncertainty. Many long-term investors might argue that the erratic nature of cryptocurrency markets makes them unsuitable for those with a low risk tolerance. While some view volatility as a necessary characteristic of an emerging market, it is crucial for potential investors to weigh both the risks and rewards before diving into this unpredictable landscape.