Bright Insights Hub

Your go-to source for the latest news and information across various topics.

Staking Your Claim: How Crypto Staking Systems Can Grow Your Wealth While You Sleep

Discover the secrets of crypto staking and unlock passive income potential—grow your wealth while you sleep!

Understanding Crypto Staking: A Beginner's Guide to Earning Passive Income

Understanding crypto staking is crucial for anyone looking to explore the world of cryptocurrency investments. Staking is the process of participating in the proof-of-stake (PoS) consensus mechanism, which allows users to earn passive income by locking up their cryptocurrencies in a network for a specified period of time. Essentially, by staking your coins, you're helping to secure the blockchain, validate transactions, and in return, you receive rewards in the form of additional coins. This beginner's guide will walk you through the basics of staking, its benefits, and some key considerations to keep in mind.

To get started with crypto staking, you'll need to choose a cryptocurrency that supports this feature. Some popular options include Ethereum 2.0, Cardano, and Polkadot. Once you've selected a coin, the next step is to find a secure wallet that allows staking and to research or join a staking pool to maximize your rewards. Staking pools enable multiple users to combine their resources, increasing the chances of earning rewards as a group. Remember to consider factors like annual returns, lock-up periods, and the credibility of the platform you're using before diving in.

Counter-Strike is a popular first-person shooter game that has been a staple in the gaming community for years. Players can join either the terrorist or counter-terrorist team to engage in tactical combat. For players looking to enhance their gaming experience, you might want to check out this rollbit promo code for some exciting bonuses. The game's strategic gameplay and team dynamics make it a favorite among esports enthusiasts.

The Benefits of Staking Your Cryptocurrency: Maximize Your Returns

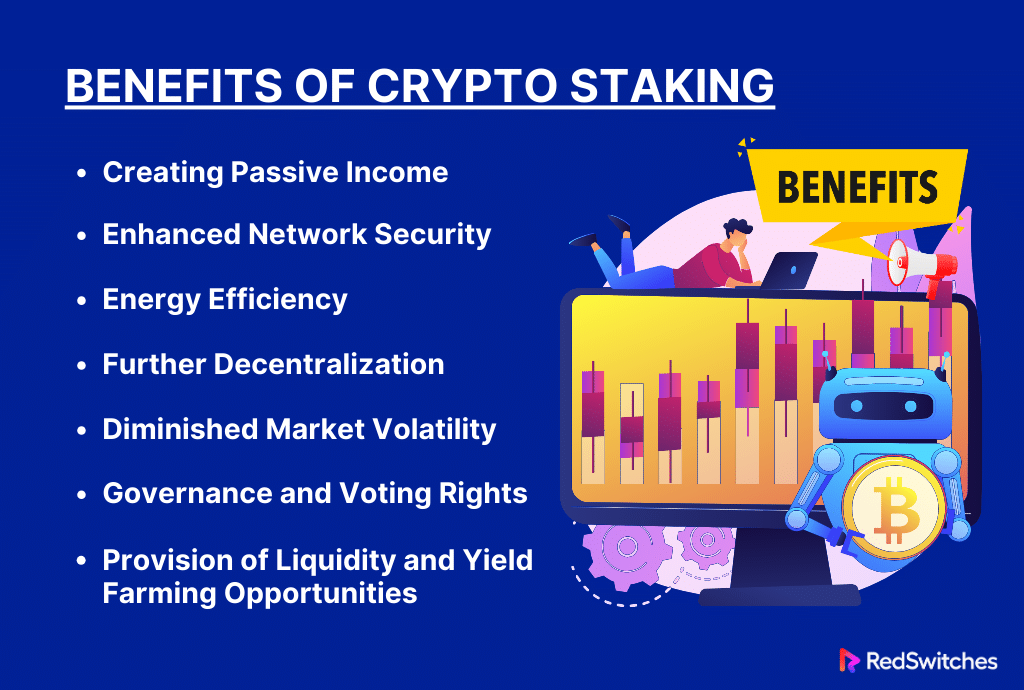

Staking your cryptocurrency offers a myriad of benefits that can significantly enhance your investment strategy. Unlike traditional trading, staking allows you to earn passive income on your crypto holdings. When you stake your coins, you are essentially locking them up to support the operations of a blockchain network. In return, you receive rewards in the form of additional coins or tokens, which can accumulate over time. This process not only helps secure the network but also allows you to maximize your returns without the need for constant buying and selling.

Moreover, staking contributes to the overall health and efficiency of the blockchain ecosystem. As a stakeholder, you have a vested interest in the success of the network, which promotes a more stable and secure environment for all users. Additionally, staking often involves lower risks compared to other investment strategies. The rewards can be more predictable, which helps in financial planning and cash flow management. Overall, by engaging in staking, you can effectively leverage your cryptocurrency investments and explore new avenues for wealth growth.

Is Crypto Staking Right for You? Key Factors to Consider Before You Invest

When considering whether crypto staking is right for you, it's essential to evaluate your financial goals and risk tolerance. Unlike trading, which often requires active management and market timing, staking allows you to earn passive income through your crypto assets. This process involves locking up your cryptocurrency to support the operations of a blockchain network, which typically rewards you with additional tokens. However, it’s crucial to understand that the returns can vary significantly based on the project and market conditions, so conducting thorough research is imperative.

Another key factor to consider is the liquidity of the asset you wish to stake. Some staking protocols may lock your funds for a set period, making it difficult to withdraw if market conditions shift. Additionally, consider the security and reliability of the staking platform. Evaluate its history, reputation, and the potential risks involved, such as smart contract vulnerabilities. Ultimately, if you have a long-term investment strategy and are comfortable with the associated risks, staking might be a viable option for diversifying your crypto portfolio.