Bright Insights Hub

Your go-to source for the latest news and information across various topics.

Staking Your Claim: How Crypto Staking Systems Turn You into a Digital Farmer

Discover how crypto staking transforms you into a digital farmer, reaping rewards while growing your crypto assets effortlessly!

Understanding Crypto Staking: The Basics of Digital Farming

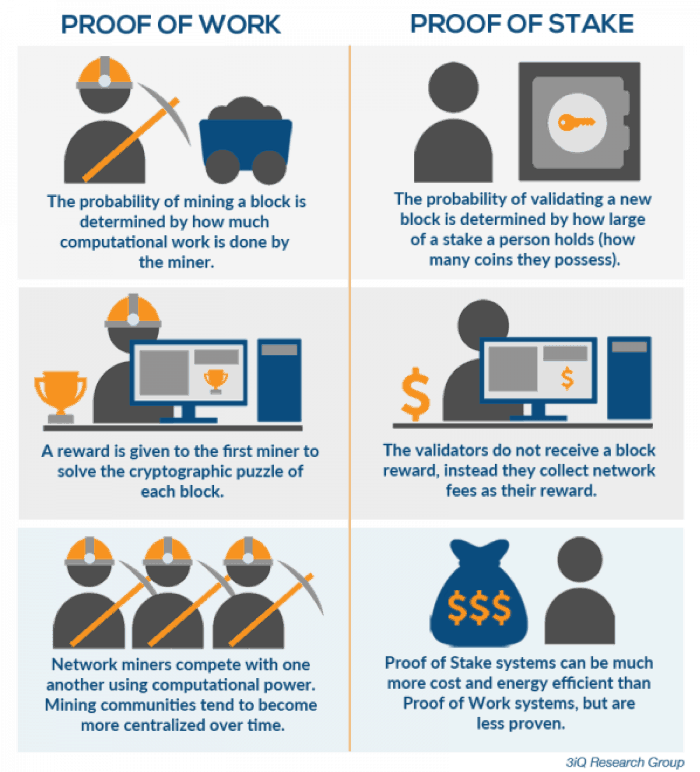

Crypto staking is a groundbreaking concept in the realm of cryptocurrencies that allows investors to earn rewards by participating in the proof-of-stake mechanism. Instead of mining blocks, as with proof-of-work systems, staking involves holding a certain amount of digital currency in a designated wallet to support the operations of a blockchain network. By locking up their tokens, participants help secure the network and, in return, receive rewards, often in the form of additional tokens. This process not only contributes to network security but also provides a passive income opportunity for investors looking to leverage their crypto assets.

To get started with crypto staking, here are a few fundamental steps to follow:

- Choose a cryptocurrency that supports staking, such as Ethereum 2.0, Cardano, or Polkadot.

- Select a suitable staking wallet or platform that allows you to stake your tokens securely.

- Determine the minimum amount required to stake, as some networks have specific thresholds.

- Begin staking and monitor your rewards regularly.

Understanding these basic concepts can help you make informed decisions in the world of digital farming through crypto staking.

Counter-Strike is a popular first-person shooter game that has captivated millions of players around the world. With its tactical gameplay and team-based strategies, players are constantly engaging in intense matches. For those looking to enhance their gaming experience, you might want to check out the rollbit promo code to unlock exciting features and rewards.

Maximize Your Earnings: Strategies for Successful Crypto Staking

Maximizing your earnings through crypto staking requires a strategic approach that goes beyond simply locking up your assets. First, it's crucial to assess the staking platforms available to ensure they are reputable and secure. Look for platforms that offer high staking rewards, a solid track record, and user-friendly interfaces. Additionally, consider diversifying your staking portfolio by participating in multiple cryptocurrencies that yield favorable returns, as this can mitigate risks and enhance your overall earnings.

Once you've selected your staking assets, implementing proper staking strategies is essential. This can include utilizing (a) auto-compounding features on certain platforms, which can significantly boost your returns over time by automatically reinvesting your rewards. Secondly, (b) setting a long-term staking timeline can help you take advantage of compounding interest, allowing your earnings to grow exponentially. Lastly, stay informed about market trends and updates on the cryptocurrencies you're invested in, as these can impact your staking rewards and overall profitability.

Is Crypto Staking Worth It? Pros and Cons of Becoming a Digital Farmer

Crypto staking has emerged as a popular option for investors seeking to earn passive income from their cryptocurrency holdings. By participating in this process, users essentially lock up a portion of their digital assets to support the operations of a blockchain network. In return, they can receive rewards such as additional tokens. The main advantage of crypto staking is the potential for generating a steady yield, often higher than traditional savings accounts. Additionally, staking generally contributes to the network's overall security and efficiency, allowing you to play an active role in the ecosystem while earning rewards.

However, there are also cons that must be considered before diving into crypto staking. Firstly, the initial investment can be substantial, and certain tokens may require a minimum lock-up period, restricting liquidity. Secondly, the volatility of cryptocurrency markets means that while staking rewards can be appealing, the value of the staked assets may decrease significantly, offsetting any earnings. Furthermore, there are risks associated with the staking process itself, such as potential hacks or technical failures that can affect your rewards. Therefore, it's crucial to weigh the pros and cons carefully before becoming a digital farmer in the world of crypto staking.